Let's cut to the chase: B2B lead qualification is the art of sorting the tire-kickers from the real buyers. It's a system for figuring out which prospects are actually a good fit before your sales team pours time and energy into them. When you get this right, your reps spend their days having meaningful conversations with people who can actually sign on the dotted line.

No more chasing dead ends.

Why B2B Lead Qualification Is Your Sales Engine

Without a solid qualification process, your sales team is essentially flying blind. They waste countless hours on leads who don't have the budget, the authority, or a real problem your product can solve. That's not just a drain on morale; it kills your revenue and makes forecasting feel like a total shot in the dark.

A structured qualification process turns that chaos into a predictable growth engine.

Think of it as a bouncer for your sales pipeline. It ensures only the most promising opportunities—the ones that match your Ideal Customer Profile (ICP)—get past the velvet rope. This is the critical handoff point where marketing's hard work turns into real sales action.

The MQL vs SQL Distinction

At the core of all this is the difference between a Marketing Qualified Lead (MQL) and a Sales Qualified Lead (SQL). These aren't just fancy acronyms; they’re fundamental stages that keep your teams aligned and focused.

Here’s a quick reference table I always share with teams to clear up any confusion between marketing and sales.

MQL vs SQL Key Differentiators

| Attribute | Marketing Qualified Lead (MQL) | Sales Qualified Lead (SQL) |

|---|---|---|

| Stage | Early-stage awareness and interest | Mid-to-late stage, ready for sales |

| Engagement | Downloads a whitepaper, attends a webinar, visits key pages | Requests a demo, asks for pricing, fills out a contact form |

| Intent | Researching a problem or solution area (curious) | Evaluating specific vendors to solve a problem (serious) |

| Ownership | Marketing team nurtures with content and education | Sales team takes over for direct follow-up and discovery |

| Next Step | Nurture until they show signs of purchase intent | A discovery call or demo with a sales rep |

Having this clear line in the sand is crucial. It stops sales from pouncing on leads who are still just browsing and gives marketing the space to warm them up until they’re genuinely ready to talk business.

The Impact of Speed and Structure

Responding quickly and having a clear process from the get-go makes a huge difference. For example, the top B2B SaaS companies hit a ~39% lead-to-MQL conversion rate, which shows just how powerful good tracking and an automated process can be. You can find more details on these lead qualification statistics to see how you stack up.

Proper qualification isn't just about finding good leads; it’s about managing your entire revenue funnel better. For a deeper dive, check out our guide on how to manage your sales pipeline, which builds on these exact principles.

A well-oiled qualification process also creates an invaluable feedback loop. Sales can tell marketing what makes a lead great, which helps the marketing team fine-tune their campaigns to attract more of the right people. That alignment is the real secret sauce to predictable growth.

Defining Your Ideal Customer Profile

Before you can even think about qualifying leads, you have to know what a great lead looks like. If you don't, your sales team is essentially flying blind, wasting time and energy on companies that will never buy. This is where your Ideal Customer Profile (ICP) comes in.

Forget vague personas. An ICP is a laser-focused, data-driven description of the exact type of company that gets the most value from your product. It’s a blueprint built by studying your absolute best customers—the ones who ramp up quickly, stick around for the long haul, and become your biggest advocates.

This profile becomes the North Star for your sales and marketing teams. It helps you instantly spot high-potential prospects and politely ignore the time-wasters. That focus is critical, especially when you learn that a staggering 61% of B2B marketers just dump every lead on sales, even though only a tiny fraction are actually qualified.

The Core Components of Your ICP

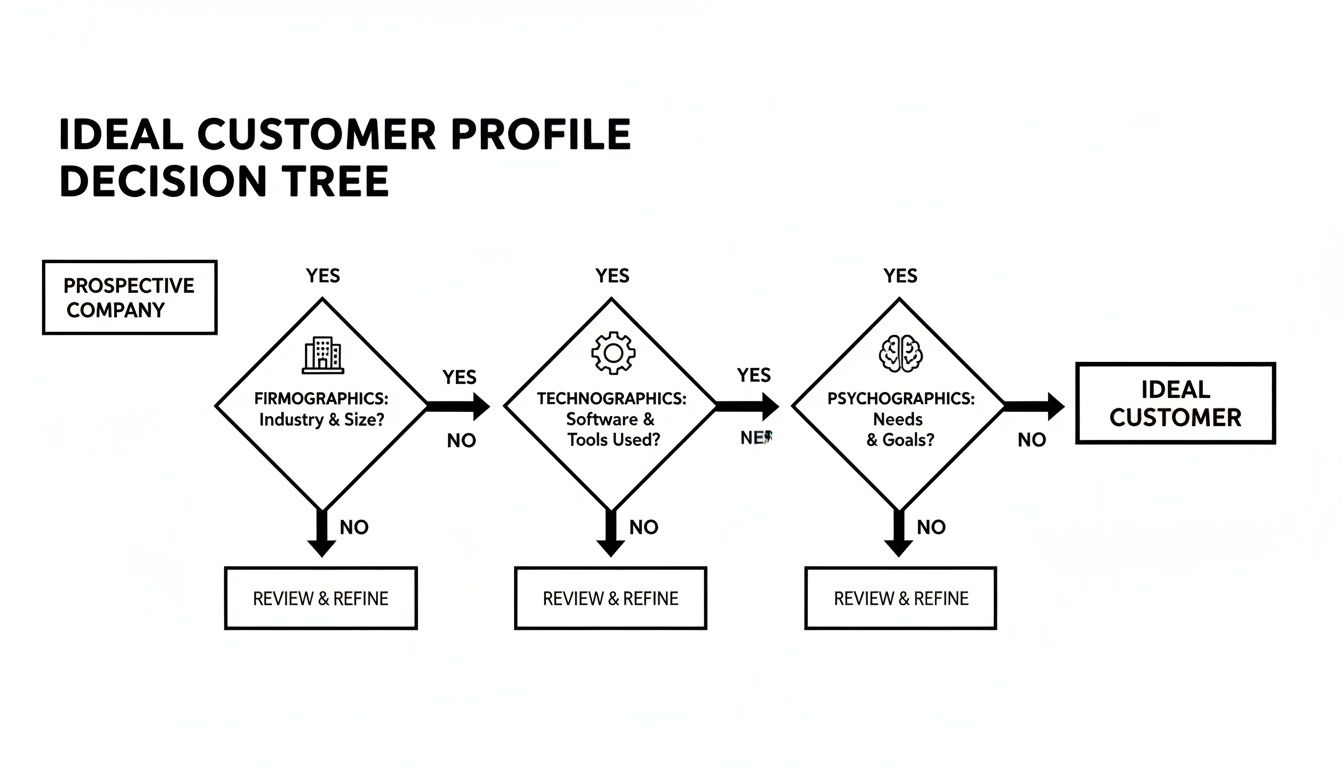

A truly effective ICP goes way beyond the basics. It's built on three layers of data that give you a complete picture of your target accounts.

- Firmographics: This is the high-level, "on paper" information about a company. Think industry, annual revenue, employee count, and where they're located. It's the first filter.

- Technographics: This layer tells you what technologies a company already uses. Do they have software that integrates with yours? Are they using a competitor's product? This information provides crucial context and can signal buying intent.

- Psychographics: This is where you get to the "why." What are their biggest goals? What operational headaches are they dealing with? What triggers their buying process? This gets to the heart of their pain points.

Putting it all together is how you go from a vague "we sell to software companies" to a powerful "we sell to mid-market SaaS companies in North America with 100-500 employees that use Salesforce and are struggling with sales forecasting accuracy." See the difference? One is a guess; the other is a strategy.

How to Gather Your ICP Data

Building an accurate ICP isn't about sitting in a room and brainstorming. It's about doing a little detective work with the data you already have.

First, talk to your sales reps. They're on the front lines every single day. Ask them which deals closed the fastest or which customers "just got it" right away. Their stories and instincts are an absolute goldmine.

Next, get into your CRM. Run a report on your top 10 or 20 customers by revenue, lifetime value, or product usage. Look for the patterns. What industries, company sizes, or lead sources do they all have in common? This hard data will either confirm your team's gut feelings or point you in a new direction.

Pro Tip: The best source of information is often the customer themselves. Reach out to a few of your happiest clients and ask for 15 minutes of their time. Ask about their buying process, what their "aha" moment was, and how they sold the purchase internally. You’ll be amazed at what you learn.

Once you have all this info, write it down and share it with everyone. Your ICP shouldn't be a dusty document on a server somewhere; it's a living guide that needs to be revisited and tweaked every six months or so. This ensures everyone stays aligned on how to qualify B2B leads and keeps your revenue engine running smoothly.

Choosing Your Sales Qualification Framework

Alright, you've figured out who you're selling to. Now, the real work begins: creating a repeatable process for your sales conversations. This is where a sales qualification framework comes in. Think of it as a playbook for your discovery calls.

Without a framework, every rep on your team is flying blind, qualifying leads their own way. That chaos leads to messy pipelines, inconsistent data, and a sales process that’s more guesswork than strategy. A solid framework gets everyone speaking the same language and hunting for the same buying signals. It's about turning random conversations into a predictable system.

This isn't just about ticking boxes. A strong qualification process acts like a multi-layered filter. It helps you systematically weed out poor-fit leads so you can focus your energy on the ones that actually matter. You start broad and get progressively more specific.

As you can see, the idea is to ensure you're investing time in prospects who are a match on every level—company, technology, and strategic goals. Let's dig into the three most common frameworks that sales teams use to bring this filtering process to life.

BANT: The Classic Approach

BANT is the old-school classic, originally cooked up by IBM. It's simple, direct, and gets the job done. For teams just getting started with a structured qualification process, it’s a fantastic entry point.

Here's what it stands for:

- Budget: Do they actually have money set aside for a solution like yours?

- Authority: Are you talking to the person who can sign the check, or just an influencer?

- Need: Is there a real, painful problem that your product solves?

- Timeline: How quickly do they need to fix this problem?

BANT works exceptionally well for high-volume, transactional sales where the decision-maker is easy to identify. The big catch? In modern B2B sales, budgets are often created for compelling solutions, not pre-approved. Sticking too rigidly to BANT can cause you to disqualify perfectly good opportunities just because they haven't allocated funds yet.

MEDDIC: For Complex Enterprise Deals

When you're chasing the big fish—those massive, complex enterprise deals—MEDDIC is the undisputed champion. It’s far more rigorous than BANT and is built specifically to help reps navigate labyrinthine buying committees and sales cycles that stretch for months.

This framework forces you to go deep:

- Metrics: What are the hard numbers they need to hit? Think "increase revenue by 15%" or "reduce churn by 10%."

- Economic Buyer: Who is the person with ultimate P&L responsibility? This is the one person who can truly say "yes."

- Decision Criteria: How are they judging you? Get the specific technical, financial, and vendor requirements they'll use to compare options.

- Decision Process: What are the exact stages, paperwork, and approvals needed to get from evaluation to a signed contract?

- Identify Pain: What's the core business pain driving this whole thing, and what happens if they do nothing?

- Champion: Who on the inside loves your solution and is willing to sell it for you internally?

MEDDIC is an absolute powerhouse for deals over six figures, but it’s definitely overkill for smaller, faster sales. It trains your reps to think like a strategist, not just a seller.

MEDDIC isn’t just a checklist; it's a strategic tool. It helps you identify your internal champion and understand the specific metrics they care about, which is the key to building a compelling business case they can take to the economic buyer.

CHAMP: The Customer-Centric Alternative

CHAMP flips the traditional model on its head. It's a more modern approach that leads with the customer’s problems, not their wallet. This makes it a natural fit for any team practicing consultative or value-based selling.

Here's the breakdown:

- Challenges: What specific roadblocks are holding their business back?

- Authority: Who is involved in making this decision? (This is a subtle but important shift, acknowledging that most B2B deals involve a committee, not a single decision-maker).

- Money: Is a budget available, or can we build a business case strong enough to create one?

- Prioritization: Where does solving this problem rank on their list of priorities right now?

By starting the conversation with Challenges, your reps immediately position themselves as problem-solvers, not just vendors. It feels less like an interrogation and more like a collaborative discussion. This framework is fantastic for building rapport and uncovering pain points the prospect might not have even fully recognized themselves.

BANT vs MEDDIC vs CHAMP At a Glance

Feeling a bit overwhelmed? Don't be. Choosing the right framework really comes down to your sales cycle, deal size, and the complexity of your customers' organizations. Each one has its strengths.

| Framework | Best For | Primary Focus | Key Limitation |

|---|---|---|---|

| BANT | High-volume, transactional sales cycles | Seller's needs (Budget, Authority) | Can be too rigid; might disqualify good leads early. |

| MEDDIC | Complex, high-value enterprise deals | Deep deal intelligence & risk assessment | Overkill for smaller, simpler sales processes. |

| CHAMP | Value-based, consultative selling motions | Customer's challenges and priorities | Requires reps to be skilled at uncovering unstated needs. |

Ultimately, the "best" framework is the one your team will actually use consistently. Start with the one that feels like the most natural fit, and don't be afraid to adapt it. You can even borrow elements from different frameworks to create a hybrid model that works perfectly for your business.

Building a Powerful Lead Scoring Process

So, you’ve defined your ideal customer and picked a qualification framework. Now it's time to stop the manual sifting and start automating. This is where lead scoring comes in, turning your qualification strategy from a simple checklist into a well-oiled machine.

Think of it as a point system that automatically ranks your leads. It assigns positive or negative points based on who they are and how they’ve interacted with your brand. The whole point is to surface the hottest prospects so your sales team knows exactly who to call right now.

A solid lead scoring model means your reps are spending their valuable time on conversations that actually have a chance of closing, instead of chasing down maybes. It’s all about capitalizing on intent. When a lead with the perfect job title from a target industry lands on your pricing page, that’s a massive buying signal. Lead scoring catches that moment and bumps them straight to the front of the queue.

Defining Your Scoring Criteria

Good lead scoring boils down to two types of data: explicit (what they tell you) and implicit (what they do).

First, you'll assign points for attributes that scream "Ideal Customer Profile." This is the "who they are" part of the equation.

- Positive Explicit Attributes:

- Job Title (+15 points): Give a big score to C-Suite or VP titles. They’re the decision-makers.

- Industry (+10 points): A lead from one of your core target industries is obviously a better fit.

- Company Size (+5 points): If they fall within your sweet spot for employee count, add some points.

Don't forget you can also subtract points to weed out the noise. A student with a university email address? That’s a -20. A lead from a country you don't serve? Knock off 10 points.

The other half of the puzzle is behavioral scoring. This is where you track their actions, which signal their interest level.

- Positive Implicit Behaviors:

- Requested a Demo (+25 points): This is the holy grail of buying signals. Max points here.

- Visited Pricing Page (+10 points): They’re clearly thinking about budget, which means they're serious.

- Downloaded a Case Study (+5 points): This shows they're actively researching solutions like yours.

- Opened 3+ Marketing Emails (+3 points): A small but important sign of consistent engagement.

The Power of Data Enrichment

Let's be real: one of the biggest headaches with lead scoring is getting incomplete info. A lead might drop their name and email, but that’s it. You’re left guessing their company size, industry, or job title. This is exactly where data enrichment tools save the day.

Services like ZoomInfo, Clearbit, or Apollo are game-changers. They can take a single piece of information, like an email address, and instantly flesh out the lead’s entire profile in your CRM. You get crucial firmographic data—company revenue, employee count, industry—along with the contact's exact title and seniority.

By enriching leads the second they come in, you get the full picture you need for accurate scoring. This completely eliminates the tedious manual research reps used to do and makes sure your automated rules fire correctly from the get-go.

Implementing Scoring in Your CRM

Your CRM is where all this magic happens. Most modern CRMs have lead scoring features baked in or connect easily with marketing automation platforms that handle it. The setup is all about creating rules that trigger point changes based on your criteria.

For instance, a simple rule might look like this: IF Job Title contains "VP" AND Industry is "SaaS", THEN add 25 points.

Once a lead hits a specific score—let's say 100 points—you can set up a workflow to automatically flip their status from "Marketing Qualified Lead" to "Sales Qualified Lead" and assign them to the next available rep. This creates a frictionless handoff, feeding high-quality leads directly to your sales team.

Some teams are even taking it a step further, using https://b2bcrm.net/predictive-sales-ai/ to analyze historical data and better predict which leads are most likely to close, adding another powerful layer of intelligence to the process.

When you combine a smart scoring model with data enrichment and CRM automation, you create a system that ensures your sales team is always focused on the absolute best opportunities in the pipeline.

Making Your CRM Work for You, Not Against You

Your qualification frameworks and scoring models are just theory until you put them into practice. And the place where it all comes to life is your CRM. Without a smart, thoughtful setup, even the best strategy just creates more manual work and headaches.

Think of your CRM as the central nervous system for your entire sales process. It's what takes a hot lead, instantly gets it to the right salesperson, and gives them all the context they need for a great first conversation. This isn't just about being efficient; it's about connecting with a potential customer the moment their interest is highest.

Set Up Smart Lead Routing

Manual lead assignment is a momentum killer. A promising lead comes in, sits in a digital purgatory, and waits for a manager to finally hand it off. By the time a rep actually makes the call, the prospect’s initial excitement has likely vanished. Automated lead routing fixes this problem completely.

The idea is to build rules that assign leads the second they cross your "Sales Qualified" threshold. These rules can be as simple or complex as your sales team's structure requires.

- Territory-Based Routing: The classic approach. Assign leads based on geography—state, country, or a custom sales region.

- Expertise-Based Routing: Got specialists? Route leads from a specific industry (like "Manufacturing" or "Fintech") to the rep who knows that world inside and out.

- Round-Robin Routing: Perfect for teams where everyone covers the same ground. This system distributes leads evenly, ensuring a fair and balanced workload for all.

For instance, you could create a workflow that says: "When a lead's score hits 100 AND their industry is 'SaaS,' assign it to Jane Doe." A simple rule like this makes sure your best leads get to your most prepared reps without a single second wasted.

Build Automated Follow-Up Sequences

Even the most organized salespeople can have a lead slip through the cracks. It happens. That’s where automated sequences become a rep’s best friend, ensuring every qualified lead gets consistent, timely attention.

You can build these follow-up cadences right inside your CRM. Imagine a new SQL is assigned to a rep. Your CRM can instantly create a task for that rep to call them within one hour. If there's no answer, the system can automatically send a personalized follow-up email from that rep's account 24 hours later.

This kind of automation takes the guesswork out of the process. It ensures every lead gets the right touchpoints at the right time. To get a better handle on building these workflows, our guide on B2B marketing automation is a great place to start.

Customize Lead Statuses and Fields

Generic CRM stages like "Open" or "Contacted" don't tell you much. To really understand what's happening in your pipeline, you need to customize your lead statuses to mirror your actual sales journey.

Create distinct stages that tell a clear story:

- New: Fresh in the system, untouched.

- Attempting Contact: The rep is actively reaching out.

- Connected: A real, two-way conversation has happened.

- Qualified: The lead has been vetted against your criteria (BANT, MEDDIC, etc.).

- Disqualified: Not a good fit, with a reason noted.

Here's a pro tip: Make the "Disqualification Reason" a mandatory field. Is it bad timing? No budget? The wrong contact? This feedback is pure gold for your marketing team, helping them tweak their campaigns to bring in better-fit leads next time.

This level of detail makes your pipeline reports infinitely more accurate and helps you spot exactly where deals are stalling. It also highlights which channels are paying off. We know SEO leads tend to have a high close rate—around 14.6%—and that most B2B social leads come from LinkedIn. When you track lead sources and disqualification reasons in your CRM, you get a clear, data-backed picture of what's actually driving revenue.

Measuring and Refining Your Qualification Process

Here’s the thing about lead qualification: it’s not a “set it and forget it” kind of deal. You can’t just build a scoring model, define your ICP, and call it a day. If you aren't constantly measuring and tweaking, you're essentially flying blind.

Think of it like tuning a high-performance engine. You need to listen to what the data is telling you, make small adjustments, and see how it impacts performance. The goal is to build a well-oiled machine that feeds your sales team high-quality, ready-to-engage opportunities. This only happens when you base your decisions on real-world results, not just old assumptions.

Key Metrics to Track

To get started, you need to know what’s actually working. Let's cut through the noise and skip the vanity metrics. We're looking for the numbers that have a direct line to revenue.

Here are the essential KPIs you should have on your dashboard:

- MQL-to-SQL Conversion Rate: This is the big one. It tells you what percentage of marketing-qualified leads are actually accepted by the sales team. If this number is low, it’s a massive red flag signaling a disconnect between your teams.

- Sales Cycle Length: A truly qualified lead should move through your pipeline faster. If your "qualified" leads are taking just as long to close as any other, your scoring model might be off.

- Win Rate by Lead Source: Where are your best deals coming from? Are they from organic search, a specific webinar, or referrals? Knowing this tells marketing exactly where to invest their time and money.

- Lead-to-Opportunity Conversion Rate: Of the leads sales accepts (SQLs), how many actually become a real, tangible sales opportunity? This is a fantastic gut-check on the overall health and quality of the leads your process is producing.

Closing the Feedback Loop

Numbers tell you what is happening, but it’s your team on the ground that can tell you why. A tight, consistent feedback loop between your sales and marketing teams is absolutely critical for improving how you qualify B2B leads.

Your sales reps are in the trenches every day; their insights are pure gold.

The easiest way to capture this is right inside your CRM. Make a "Disqualification Reason" field mandatory when a sales rep rejects a lead. Was the budget not there? Was it just bad timing? Or was the contact not the right person? This is the raw feedback marketing needs to hear.

Get a recurring meeting on the calendar—even a quick 30 minutes every other week works wonders. Use that time for marketing to share which campaigns are driving MQLs and for sales to give real, boots-on-the-ground feedback on why some leads were fantastic while others were a complete dud. This isn’t about pointing fingers; it’s about working together to make the entire process smarter and more effective over time.

Common B2B Lead Qualification Questions

Even with a great playbook, you're going to run into some tricky situations. Let’s walk through a few of the most common questions I hear from teams trying to nail down their B2B lead qualification process.

What's the Biggest Mistake Companies Make?

Hands down, the single biggest mistake is making assumptions. Too many sales teams see one shiny data point—a great job title or a well-known company logo—and immediately jump the gun.

They skip the hard work of discovery and rush straight into a demo. The result? They waste an hour only to find out the person has no budget, no authority, and no real problem to solve. It’s a classic case of happy ears, and it leads to a bloated pipeline full of dead ends.

A lead isn't qualified until they've checked all your boxes—not just the one that looks good on paper. Patience during qualification actually speeds up your sales cycle.

How Often Should We Update Our ICP?

Your Ideal Customer Profile shouldn't be a "set it and forget it" document. Think of it as a living, breathing guide that needs regular attention. I recommend a formal review at least every six months, or sooner if you hit a major business milestone.

When is it time for a refresh?

- You're entering a new market. The perfect customer in Europe might look completely different from your ideal buyer in North America.

- You're launching a new product. New features and capabilities often attract a whole new audience with different needs.

- You're seeing shifts in the market. Your buyers' priorities are always changing, and your ICP has to keep up with that reality.

Can a Disqualified Lead Become Qualified Later?

Absolutely. "Not now" almost never means "not ever." The lead who was disqualified today for having no budget could land a fresh round of funding next quarter. The contact who didn't have buying power might just get promoted into a decision-making role.

This is precisely why having a clear "Disqualification Reason" field in your CRM is mission-critical.

Tag these leads correctly, drop them into a long-term nurture sequence, and let automation do the work. A simple, helpful email every few months keeps you on their radar. That way, when their situation finally changes, you're the first person they think to call.